Executive Summary

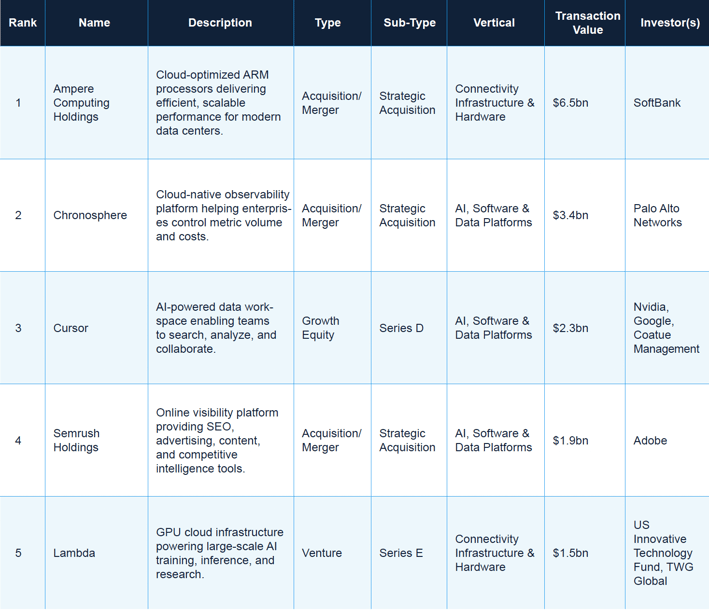

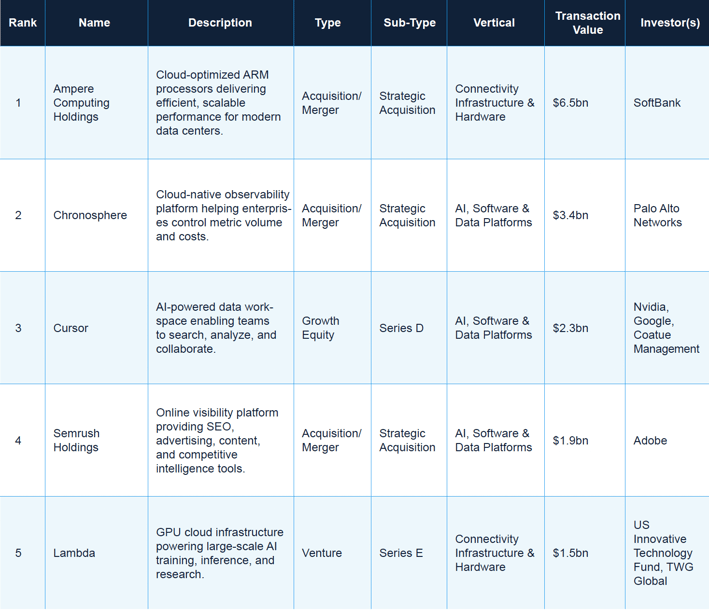

November saw a string of notable technology deals across infrastructure, software, and data platforms, with disclosed values ranging from $300 million to $6.5 billion. SoftBank completed its $6.5 billion acquisition of Ampere Computing Holdings LLC, strengthening energy-efficient computing for cloud and AI workloads. Palo Alto Networks acquired Chronosphere for $3.35 billion to expand cloud observability, while Cursor raised $2.3 billion in a Series D backed by Nvidia, Google, and Coatue Management to support its data integration platform. Other transactions included Adobe’s $1.9 billion purchase of Semrush Holdings, Lambda’s $1.5 billion Series E for AI infrastructure, and several ~$1 billion deals spanning semiconductors, cybersecurity, and enterprise software.

Overall, activity clustered around IT software and hardware tied to semiconductors, cloud infrastructure, and data-intensive applications. Acquirers such as SoftBank, Palo Alto Networks, Adobe, Atlassian, Amphenol, Clio, and EQT led M&A, while growth-stage investors including Nvidia, Google, Coatue Management, and TPG funded late-stage and pre-IPO rounds. Deal structures ranged from control acquisitions and carve-outs to minority growth equity and venture investments, demonstrating continued demand for scaled platforms that enable AI adoption and enterprise modernization.

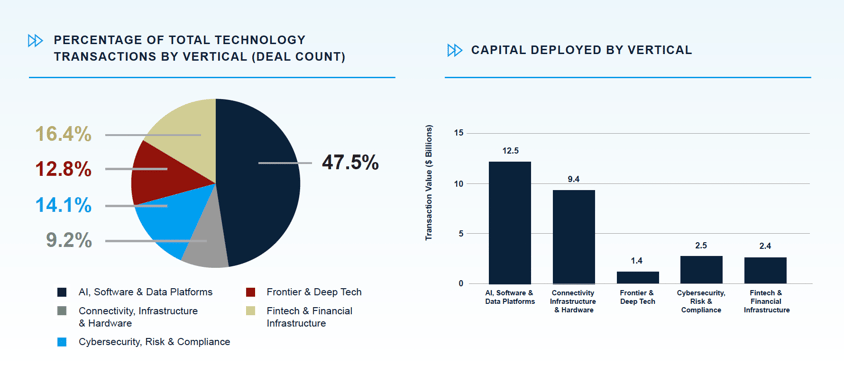

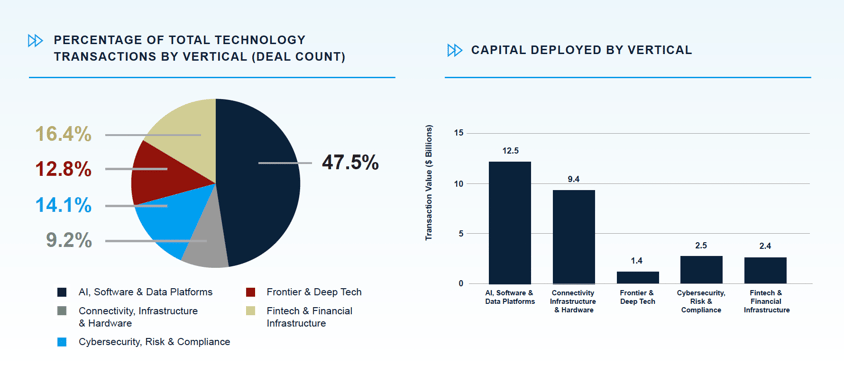

Key Segments

AI, Software & Data Platforms

Transaction Value: $12.5bn

Activity in this area in November was driven by large-scale funding rounds and acquisitions focused on core data infrastructure and multi-modal AI capabilities. Cursor’s $2.3 billion Series D, with participation from Nvidia, Google, and Coatue Management, stood out as a major capital raise backing integrated data catalog and analytics tooling for enterprises. Luma AI’s $900 million Series C, led by Humain and Partners, reinforced investor interest in AI-native video and image-generation platforms. Adobe’s $1.9 billion acquisition of Semrush Holdings, a marketing technology and online visibility platform, added another sizable transaction that expands the role of AI in performance marketing and analytics workflows.

Beyond these flagship deals, a steady stream of mid-market financings supported AI application infrastructure and development platforms. Investments in companies such as GenSpark, Parallel Web Systems, and AirOps reflected demand for tools that make it easier to build, deploy, and operationalize AI applications. The activity also pointed to continued interest in developer productivity and web search tooling, with use cases spanning industries from mortgage to insurance. Collectively, this pattern indicates that capital is flowing both into large, established data platforms and into enabling layers that lower the friction of using AI in day-to-day enterprise operations.

Connectivity Infrastructure & Hardware

Transaction Value: $9.4bn

Transactions in this segment concentrated on high-performance compute, networking, and component suppliers that underpin AI and cloud workloads. The most prominent example was SoftBank’s $6.5 billion acquisition of Ampere Computing Holdings LLC, a provider of energy-efficient high-performance processors for cloud and AI environments, which demonstrates the ongoing interest in alternative CPU architectures optimized for large-scale computing. On the component side, Amphenol’s $1 billion acquisition of Trexon added a specialist in durable cables and connectors serving industrial, defense, medical, and computing applications, bolstering its position in critical interconnect systems.

Several growth and venture-stage financings also targeted AI infrastructure, optics, and semiconductor-adjacent technologies. Lambda raised $1.5 billion in a Series E round to expand its GPU-native AI infrastructure offerings, while Celero Communications secured $140 million to advance coherent DSP technology for AI supercomputing and optical networking. Additional capital for companies like PowerLattice and NcodiN highlighted investor focus on power-delivery technologies. It also shows growing demand for optical interconnects to support next-generation data centers and high-density computing.

Cybersecurity Risk and Compliance

Transaction Value: $2.5bn

Security-related software drew a diverse mix of growth equity and venture capital in November, emphasizing cloud, identity, and application-layer protections. TPG’s $1.0 billion joint-venture investment in HyperVault, a secure digital vault and password manager for enterprises, was a key transaction in this area, reflecting continued appetite for solutions that consolidate credentials and secrets management. Armis’ $435 million pre-IPO growth financing also stood out, supporting its agentless asset visibility and security platform across IT, OT, and IoT environments.

Earlier-stage deals rounded out the month across runtime security, CNAPP, and software supply chain risk. Several Series B rounds underscored the push to secure cloud-native workloads and distributed development environments: Sweet Security ($75 million) for a unified runtime CNAPP; Guardio ($80 million) for browser-based threat detection; Truffle Security ($25 million) for secrets detection and non-human identity protection. Activity in companies such as Teleskope and Opti shows that investors are allocating capital across the full lifecycle of security and compliance needs, rather than focusing on a single control layer.

Fintech and Financial Infrastructure

Transaction Value: $2.4bn

Transactions in this area reflected a mix of growth equity and structured financings in payments, wealth platforms, and embedded financial software. Ripple’s $500 million minority growth round was a notable deal, supporting its blockchain-based cross-border payments platform and value-transfer infrastructure for B2B payments and financial institutions. FNZ’s $650 million growth equity financing, focused on its end-to-end wealth management and outsourcing platform, further highlighted investor interest in infrastructure that serves large financial institutions.

At the application layer, several deals targeted spend management, legal and fund finance workflows, and emerging crypto infrastructure. Ramp raised $300 million to expand its corporate card and expense-management platform, while Clio secured $500 million in a Series G plus a $350 million direct-lending facility to support its legal-practice management and payments offerings. Additional capital to platforms such as Maybern, Numeric, and Deblock illustrates continued support for specialized financial analytics, fund operations, and on-chain banking solutions as financial workflows continue to digitize.

Frontier and Deep Tech

Transaction Value: $1.4bn

Investment in this segment was characterized by large rounds into AI robotics, physical intelligence, and next-generation semiconductor and materials technologies. Physical Intelligence raised $600 million in a Series B to develop foundation models, learning algorithms for robotics and physically actuated systems, targeting automation and robotics use cases. Sakana AI’s $135 million Series B and D-Matrix’s $275 million Series C further showed interest in efficient generative AI models and specialized compute for AI inference, respectively.

Additional financings focused on enabling technologies in materials, memory, and advanced manufacturing. Nanoramic Laboratories secured $54 million in their series A round to advance energy storage materials and nanotechnology solutions, while Ferroelectric Memory Company’s roughly $89 million Series C supported development of non-volatile memory for advanced chip designs. Deals involving companies such as NcodiN (optical interconnects) and Hummink (high-precision electronics printing) underscored that deep-tech capital is extending beyond software into enabling hardware. The activity also highlights growing emphasis on process innovations needed to sustain performance gains in AI.

Transaction News

This table showcases five of the largest and most significant transactions in the technology sector during November, selected for their impressive scale and importance.

Top 5 Technology Transactions - November 2025

Key Trends & Insights

- Market consolidation and selectivity: Investor sentiment has shifted from broad risk-taking to a focus on established, scaled technology businesses, leading to a wave of M&A and growth equity deals targeting companies with proven business models and stable cash flows.

- Tandem buildout of infrastructure and applications: Significant capital continues to be deployed on both foundational compute/connectivity assets and data platforms, reflecting a market consensus that demand for AI workloads will drive sustained investment in hardware and enterprise software alike.

- Embedded security as a baseline: Security and compliance capabilities are increasingly viewed as integral parts of technology stacks, with funding flowing to companies solving challenges across identity, privacy, runtime protection, and supply chain risk rather than standalone cybersecurity silos.

- Longer view on Deep Tech: Investors are underwriting large rounds across robotics, physical intelligence, new memory, and advanced materials. The pattern suggests a longer time horizon, with capital backing innovation in hardware, energy, and automation.

- Continued modernization in Fintech: The technology sector’s core role in enabling payments, wealth management, expense operations, and digital assets is reinforced by ongoing investment into platforms that serve B2B and institutional finance needs, suggesting a persistent trend toward digitized workflows along with embedded financial infrastructure.

Looking Forward

Looking forward, deal activity in technology and software is likely to remain concentrated in scaled platforms and infrastructure assets. Buyers are prioritizing targets that offer clear recurring revenue, defensible market positions, and identifiable cost or revenue synergies. Persistent focus on AI enablement, cloud infrastructure, and vertical application software should continue to shape both corporate and sponsor interest. More cyclical or lower-growth segments may face slower timelines and wider valuation dispersion. As year-end pipelines and early 2026 deal flow take shape, the mix of public-market volatility and ample private capital points to a steady but selective transaction environment. Execution certainty and quality of earnings will be central to aligning buyer and seller expectations.

About Dakota

Dakota is a financial, software, data and media company based in Philadelphia, PA. Dakota’s flagship product, Dakota Marketplace, is a database of LPs, GPs, Private Companies and Public Companies used by thousands of fundraising, deal, and investment teams worldwide to raise capital, source deals, track peers, and access comprehensive data—all in one global platform. For more information, book a demo of Dakota Marketplace!