Executive Summary

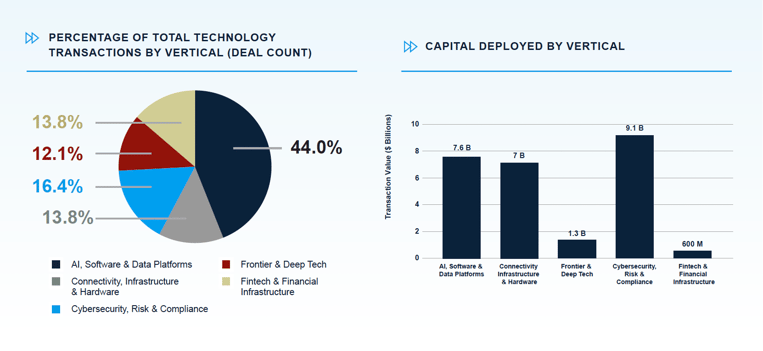

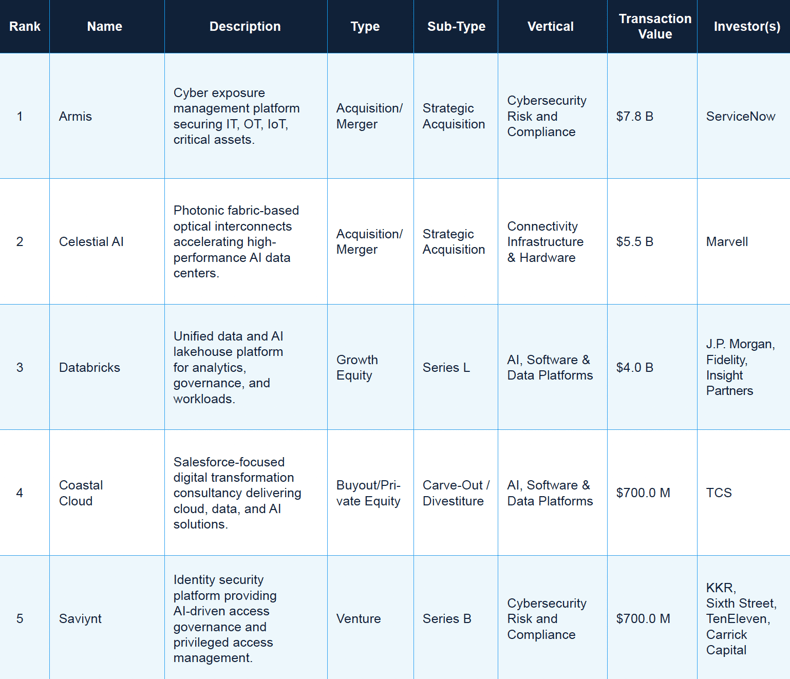

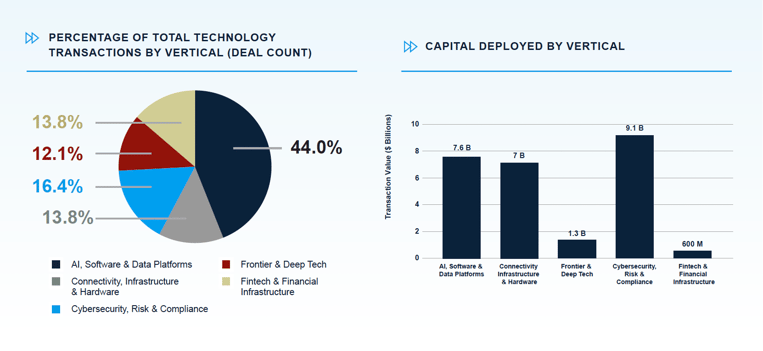

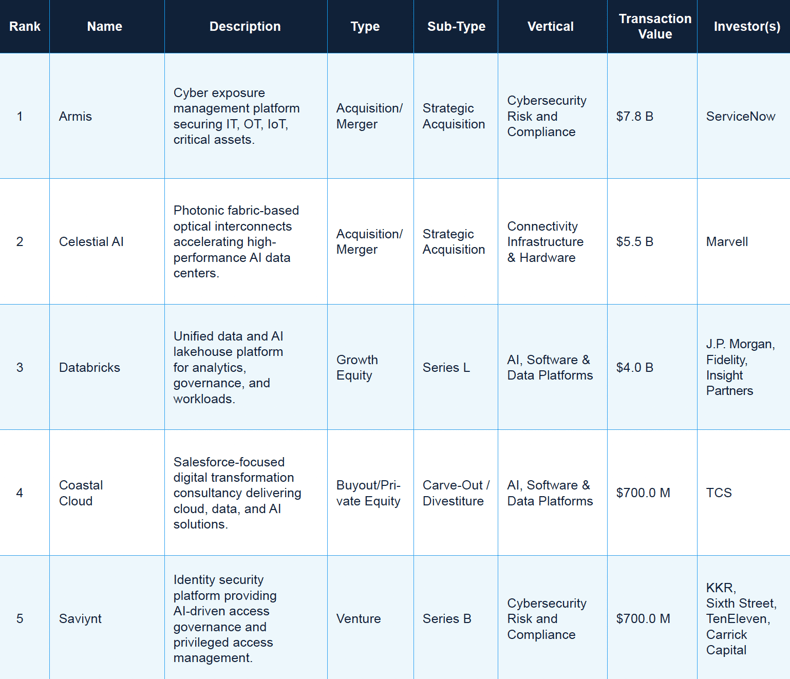

December saw a downtrend in activity across the technology landscape compared to previous months, still led by a series of large-cap strategic acquisitions and late-stage financings focused on AI, cybersecurity, and digital infrastructure. At the top end of the market, ServiceNow’s acquisition of Armis for approximately $7.8 billion and Marvell’s $5.5 billion acquisition of Celestial AI underlined strong strategic appetite for assets enabling cyber exposure management and high-performance data center connectivity, respectively. Databricks’ $4.0 billion Series L financing, alongside sizable growth equity rounds for Brevo, Saviynt, and Harness, highlighted sustained investor conviction in AI-native data platforms, customer engagement software, and identity security at scale. In parallel, private equity sponsors remained active in IT services as well as software carve-outs and bolt-ons, exemplified by transactions involving Coastal Cloud and WGNSTAR. Sponsors also continued to consolidate niche enterprise technology and IT services platforms, including investments in ComunidadFeliz and PropertyMe.

Beneath these headline deals, December’s mid-market and venture ecosystem was dominated by AI-centric, data-driven business models across core verticals, including Business Productivity Software, FinTech infrastructure, cybersecurity, and frontier deep tech. A broad cohort of early- and growth-stage rounds for companies such as Black Forest Labs, PolyAI, Axiado, and RelationalAI reflected a continued shift of capital toward enabling technologies. This momentum extended to AI agents and infrastructure platforms, including Gradial, Vinci4D, LatentForce, and The General Intelligence Company, supporting generative AI, simulation, and intelligent automation across sectors. Activity in connectivity infrastructure and semiconductor-related assets, spanning Luminar Semiconductor, Ventana Micro Systems, Corintis, and Enlightra, further emphasized the critical role of hardware-centric networking. These assets support AI workloads alongside ongoing data center build-out. Overall, December’s deal flow illustrates a market that remains highly selective yet competitive for category-leading assets at the intersection of AI, data platforms, and mission-critical infrastructure.

Key Segments

Cybersecurity Risk and Compliance

Transaction Value: $9.0B

Cybersecurity Risk and Compliance saw one of the largest security-focused strategic acquisitions of the year with ServiceNow’s $7.75 billion purchase of Armis, a cyber exposure management platform for connected assets across critical infrastructure and government. This transaction is important because it embeds asset intelligence–driven exposure management directly into a leading workflow and IT service management platform, enabling more integrated detection-to-response capabilities in environments where operational technology and IoT are increasingly exposed.

Further down the size spectrum, Saviynt’s $700 million Series B and Zafran Security’s $60 million Series C highlighted strong demand for identity security and AI-powered exposure management. These financings are interesting as they reflect a shift from perimeter- and endpoint-centric models toward identity-first, attack-surface-centric security architectures. AI is increasingly used to continuously map, simulate, and prioritize enterprise risk in highly dynamic, regulated environments.

AI, Software & Data Platforms

Transaction Value: $7.6B

AI, Software & Data Platforms continued to attract some of the largest financings in December, highlighted by Databricks’ $4.0 billion Series L round. The transaction reinforced the scale of demand for unified data and AI platforms that can serve as the backbone for enterprise analytics and governance. This transaction is notable not only for its size but also for how it consolidates Databricks’ position as a core infrastructure layer for AI workloads, positioning the company as a strategic partner to both hyperscalers and large global enterprises. Brevo’s $583 million-equivalent growth equity raises further underscored investor appetite for AI-enhanced customer engagement platforms that integrate email, SMS, CRM, and automation, reflecting the premium placed on vendors capable of unifying go-to-market and customer data in a single stack.

At the earlier stages, deals such as Gradial’s Series B and Lemurian Labs’ Series A illustrated how capital is flowing into enabling tools that sit deeper in the AI content and infrastructure stack, from agentic content supply chains to hardware-agnostic AI compilers. These transactions are interesting because they target pain points that emerge as AI adoption matures, namely, the need to industrialize content workflows and optimize AI infrastructure costs, which can yield highly scalable, horizontal platforms if executed well.

Connectivity Infrastructure & Hardware

Transaction Value: $7.0B

Connectivity Infrastructure & Hardware was characterized by large strategic moves focused on enabling next-generation data centers and high-performance computing, highlighted by Marvell’s $5.5 billion acquisition of Celestial AI. The Celestial AI transaction is important as it brings advanced Photonic Fabric optical I/O technology in-house for Marvell, bolstering its position in AI and cloud data center connectivity at a time when bandwidth and energy efficiency are critical constraints for hyperscalers.

Activity in this vertical also extended into power and interconnect ecosystems, with deals such as ZincFive’s Series F and Enlightra’s Series A demonstrating investor focus on energy-efficient hardware. These technologies support optical interconnects for mission-critical and AI-intensive workloads. Collectively, these transactions are interesting because they address the physical-layer bottlenecks, power availability, thermal management, and high-speed optical links that ultimately determine how quickly AI infrastructure can scale, making them strategic leverage points for both data center operators and semiconductor vendors.

Frontier and Deep Tech

Transaction Value: $1.3B

Frontier and Deep Tech deal flow reflected strong momentum in technologies that sit at the edge of current compute and materials capabilities, such as Black Forest Labs’ $300 million Series B to advance frontier visual AI models. This transaction is notable because it supports the development of next-generation generative media models that can power new creative, gaming, and e-commerce use cases, while also signaling investor willingness to back capital-intensive foundational model programs outside the largest U.S. labs.

On the hardware and industrial side, transactions involving Mythic and Ricursive Intelligence showed continued investment into novel AI inference architectures and ML-driven semiconductor design tools, respectively. These deals are interesting as they illustrate a push to re-architect both the chips themselves and the design processes behind them, aiming to unlock performance-per-watt and time-to-market advantages that could reshape competitiveness across AI hardware supply chains.

Fintech and Financial Infrastructure

Transaction Value: $600.0M

Fintech and Financial Infrastructure deal activity remained broad-based across core payments, embedded finance, and AI-driven financial operations. Jeeves’ $100 million credit financing expanded its ability to scale corporate spend management and financial automation capabilities, with a particular focus on supporting growing demand in the Mexican market. The Jeeves transaction is notable because it provides non-dilutive capital to scale a cross-border financial management platform serving multinational SMEs, highlighting investor confidence in asset-backed growth models within FinTech despite a more selective funding environment.

In earlier-stage FinTech, Architect Financial Technologies’ $35 million Series A and PineAI’s $25 million Series A exemplified how capital is flowing into institutional trading infrastructure and consumer-facing AI agents for personal finance. These deals are interesting as they point to a bifurcation of innovation. One end centers on institutional-grade derivatives and trading technology for digital assets; the other focuses on AI-native interfaces that abstract complex financial decisions for end users, each with the potential to materially reshape access to capital markets and retail finance.

Transaction News

This table showcases five of the largest and most significant transactions in the technology sector during December, selected for their impressive scale and importance.

Top 5 Technology Transactions - December 2025

Key Trends & Insights

- Sector remains active but selective: Across December, capital continued to flow into technology, but investors showed a clear preference for scaled platforms, recurring revenue, and profitability or near-term line of sight to cash generation, rather than broad experimentation.

- AI shifts from hype to infrastructure: AI capabilities increasingly appeared as embedded features in data platforms, developer tools, and vertical software rather than standalone “AI-only” products, reflecting a shift toward AI as core infrastructure for automation and decisioning.

- Infrastructure and applications advance in lockstep: Demand for AI-driven, data-intensive workloads reinforced parallel investment in compute, connectivity, and storage. This trend also supported continued investment in enterprise software and data platforms, supporting a view that long-term value will accrue to tightly coupled hardware–software stacks.

- Security and compliance integrated into platforms: Security, identity, and compliance capabilities were pulled deeper into core product architectures and workflows instead of sitting as isolated add-ons, signaling that buyers increasingly expect resilience and governance as built-in features.

- Verticalization and domain depth as differentiators: Technology providers that pair horizontal capabilities (data, AI, workflow) with deep industry taxonomies and domain-specific use cases saw heightened attention, as customers looked for solutions that can plug into existing processes and regulatory environments with minimal customization.

Looking Forward

The technology sector is poised for an environment where capital deployment remains disciplined but competitive around AI-native platforms, critical infrastructure, and resilient, regulation-ready architectures. Investors and strategic acquirers are likely to continue favoring assets that pair durable unit economics with clear AI leverage over proprietary data. They are also expected to closely scrutinize governance, security, and compliance capabilities as regulatory expectations around AI, cybersecurity, and financial systems tighten.

As enterprises move from pilots to production-scale deployments of AI and automation, demand should skew toward vendors that can unify data, workflows, and security across cloud environments. This shift reinforces consolidation around a smaller set of control-plane platforms as well as deep vertical specialists.

About Dakota

Dakota is a financial, software, data and media company based in Philadelphia, PA. Dakota’s flagship product, Dakota Marketplace, is a database of LPs, GPs, Private Companies and Public Companies used by thousands of fundraising, deal, and investment teams worldwide to raise capital, source deals, track peers, and access comprehensive data—all in one global platform.

For more information, book a demo of Dakota Marketplace!