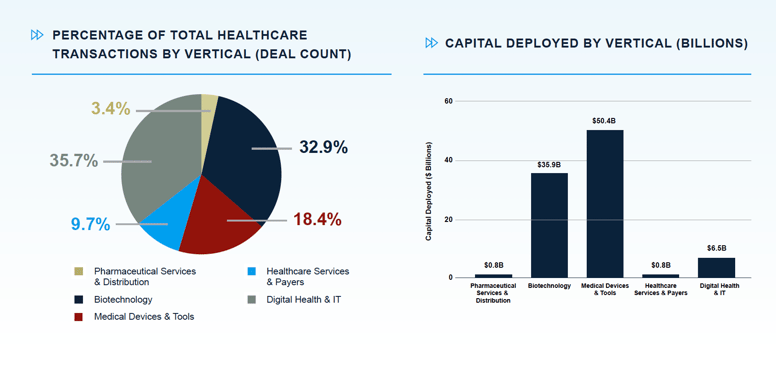

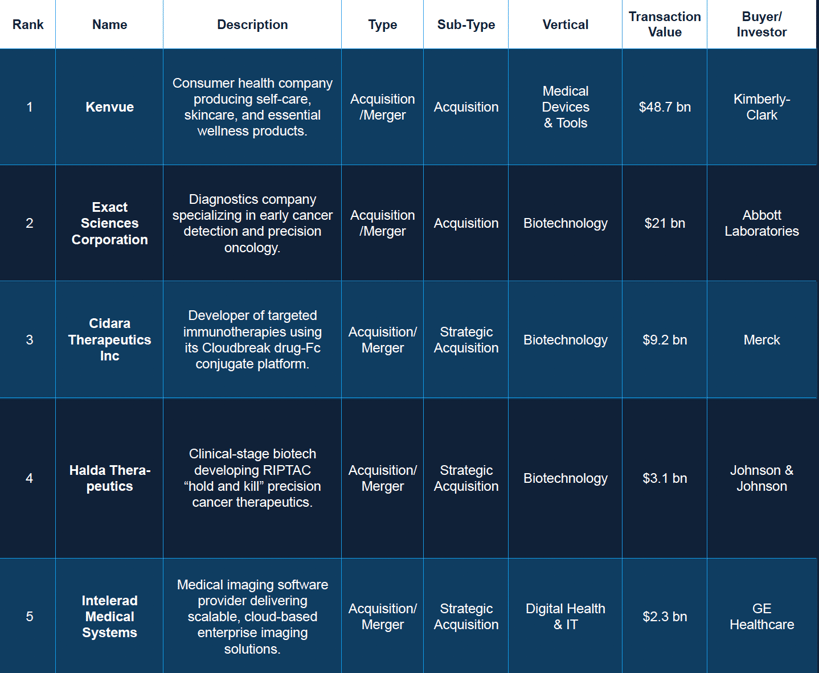

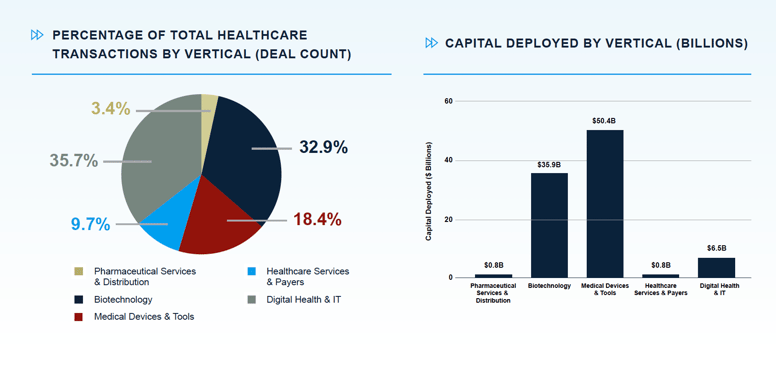

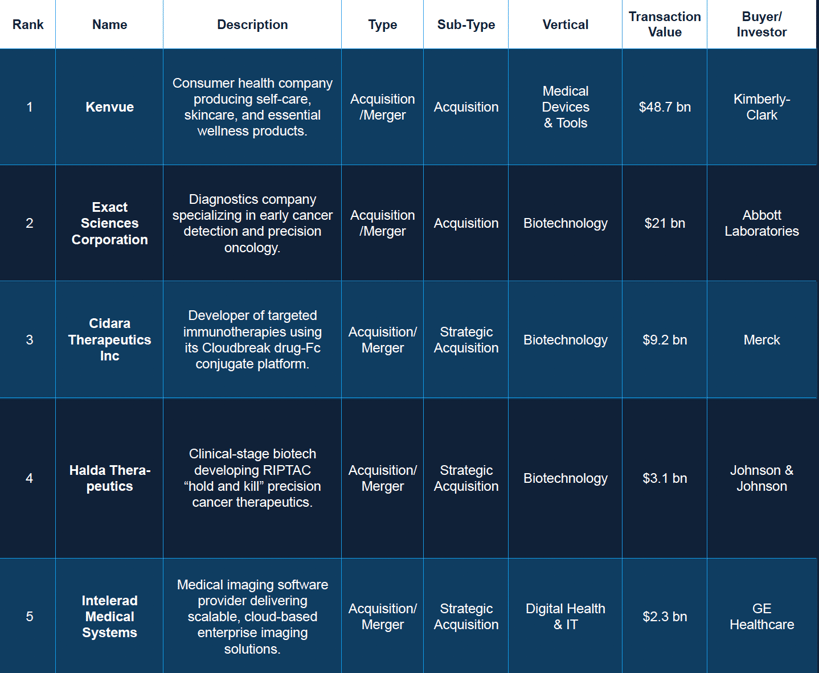

Healthcare transaction activity in November showed strong momentum across corporate acquisitions, private equity, and venture investing with $94.5 billion in total transaction value. November featured several headline transactions, including Kimberly-Clark’s agreement to acquire Kenvue in a cash-and-stock deal valued at approximately $48.7 billion and Abbott Laboratories’ agreement to acquire Exact Sciences for about $21 billion to expand its presence in cancer screening and precision oncology diagnostics, reinforcing momentum in advanced testing platforms and earlier detection. Credit markets also showed ample capacity, with marquee financings such as Morgan Stanley’s $20 billion bridge loan for Abbott Laboratories tied to its acquisition of Exact Sciences. These larger transactions underscore sustained confidence in the sector’s long-term fundamentals and the growth outlook for advanced diagnostics, biologics, and medical devices.

Investment activity remained strong across a broad set of subsectors, including biotechnology, digital health, surgical robotics, and healthcare software. Notable transactions included Merck’s acquisition of Cidara Therapeutics for $9.2 billion, Johnson and Johnson’s $3.05 billion purchase of Halda Therapeutics, and GE Healthcare’s $2.3 billion acquisition of Intelerad Medical Systems. Venture and growth equity investors remain supportive of innovation in areas such as gene therapy, personalized medicine, artificial intelligence driven platforms, and next generation surgical tools. Overall, the diversity and volume of transactions indicate a healthy investment environment and sustained appetite for high-growth healthcare technologies.

Key Segments

Medical Devices & Tools

Transaction Value: $50.4bn

The Medical Devices and Tools vertical drew interest from acquirers and investors seeking technologies that enhance clinical performance while simultaneously improving procedural efficiency. Companies in imaging, surgical systems, and advanced biomaterials stood out for their ability to provide hospitals and clinicians with more precise, patient-friendly tools. Demand also extended to platforms that integrate hardware with software to support better diagnosis and treatment planning.

Solventum’s up to $850 million acquisition of Acera Surgical reflects the appeal of high impact imaging and surgical technologies. Additional financing rounds for companies such as Distalmotion and Cornerstone Robotics illustrate continued advancement in robotics and minimally invasive devices. These developments highlight the sector’s shift toward enabling more accurate interventions and improved patient outcomes.

Biotechnology

Transaction Value: $35.9bn

Biotechnology drew significant interest in November as companies developing precision therapies, gene editing technologies, and advanced biologics attracted corporate buyers and investors. The sector remains steadfast in advancing programs in oncology, rare diseases, and regenerative medicine, supported by strong interest in platforms with differentiated science and clear clinical potential. Large pharmaceutical acquirers sought assets that could bolster pipelines and accelerate development in high unmet-need categories.

Major transactions included Merck’s $9.2 billion acquisition of Cidara Therapeutics and Johnson and Johnson’s $3.05 billion acquisition of Halda Therapeutics. Both deals underscore how established pharmaceutical companies are incorporating next generation treatments into their portfolios. Funding rounds for companies such as AAVantgarde Bio and Aspen Neuroscience further show how new modalities and specialized therapeutic technologies are influencing future drug development.

Digital Health & IT

Transaction Value: $6.5bn

Digital Health and IT attracted buyers and investors focused on strengthening clinical workflows. Demand was especially strong for technologies that expand virtual care and improve data-driven decision-making. Solutions using artificial intelligence, cloud infrastructure, and automation drew attention for their ability to reduce administrative burden and enhance performance across provider settings. The sector keeps evolving around platforms that unify data, support real time insights, and streamline provider operations.

One notable example is GE Healthcare’s acquisition of Intelerad Medical Systems for $2.3 billion, which demonstrates interest in enterprise imaging and integrated diagnostics. Axon’s $625 million acquisition of Carbyne further highlights the importance of communication and emergency response technologies. Venture financings for companies such as Hippocratic AI and RapidSOS point to growing adoption of AI enabled clinical tools and safety platforms. These developments show how digital infrastructure is helping shape the next stage of healthcare delivery.

Pharmaceutical Services & Distribution

Transaction Value: $800mn

Pharmaceutical Services & Distribution companies connect manufacturers, providers, and patients through drug distribution, specialty pharmacy, and support services that enhance adherence and outcomes in complex therapies. November 2025 activity in this vertical reflected sustained investor interest in channel optimization and specialty access, particularly in rare disease and women’s health focused products.

One example from the month is InfuCare Rx, a nationwide specialty pharmacy platform focused on high‑acuity infusion therapies for complex acute and chronic conditions, which was acquired in a private equity carve‑out transaction. The deal highlights sponsor appetite for scaled, clinically differentiated dispensing models that sit at the intersection of distribution, care coordination, and patient support.

Healthcare Services & Payers

Transaction Value: $800mn

Healthcare Services and Payers saw active consolidation as organizations pursued scale, operational improvement, and integrated care models. Investors focused on outpatient service providers, specialty practices, and home health organizations that can address rising demand for accessible and cost efficient care. The vertical also experienced interest in platforms that better coordinate care and support evolving reimbursement structures.

Representative transactions include Extendicare’s $570 million acquisition of CBI Home Health and the add-on acquisitions of Fox Valley Orthopaedic Associates and Infinity Hospice Care. These deals illustrate ongoing expansion within home health, specialty care, and value oriented service models. The range of transactions reflects interest in businesses that improve care delivery consistency and address growing patient needs across multiple care environments.

Transaction News

This table showcases five of November’s largest healthcare transactions, selected for their size and impact. Each deal reflects investment focus in the sector’s highest-growth segments.

Top 5 Healthcare Transactions - November 2025

Key Trends & Insights

- Industry Consolidation: The healthcare sector is moving toward larger, integrated platforms that combine services, technology, and clinical capabilities to improve efficiency and market reach. This trend reflects a broader effort to reduce fragmentation, strengthen contracting leverage, and create seamless patient experiences through coordinated networks and unified operating models.

- Advanced Therapeutics Innovation: Biotechnology investment trends point to sustained momentum in precision medicine, gene therapy, and next generation biologics that address high unmet medical needs. Companies are advancing more differentiated mechanisms of action, and investors are prioritizing platforms capable of delivering personalized, targeted treatments with clearer clinical pathways and long term commercial potential.

- Digital Transformation: Adoption of AI, automation tools, and data integration platforms is expanding as organizations seek to streamline operations, reduce administrative burden, and enhance clinical decision making. Health systems and technology partners are increasingly focused on solutions that unify disparate data sources and support real-time insights. These tools also enable more scalable, consistent workflows across clinical and administrative environments.

- Shift to Decentralized Care: Growth in home based care, outpatient services, and specialized care models indicates a repeated shift toward more accessible, patient centered care delivery. This evolution is supported by improved virtual care capabilities, rising consumer expectations, and payer interest in lower cost sites of care that offer greater convenience without compromising quality.

- Device and Diagnostics Advancement: Elevated focus on surgical robotics, imaging, and diagnostic technologies highlights an industry priority to improve accuracy, reduce costs, and enable earlier, more informed intervention. Innovation is increasingly centered on tools that integrate software and hardware, enhance provider precision, and support proactive clinical decision making throughout the patient journey.

Looking Forward

The healthcare sector is poised for innovation driven by scientific breakthroughs, accelerating digital adoption, and shifting care delivery expectations. Investment is likely to concentrate on platforms that combine advanced therapeutics, data-driven technologies, and scalable service models capable of meeting rising demand for personalized and efficient care. As payers and providers face mounting pressure to improve outcomes while controlling costs, integrated ecosystems that blend clinical innovation with operational intelligence will gain even greater relevance.

Concurrently, AI capabilities are maturing and decentralized care options are expanding. Rapid progress in medical devices and diagnostics will push the industry toward earlier intervention, more precise treatment pathways, and increasingly consumer-oriented experiences. Together, these forces suggest that the healthcare landscape will keep trending toward a more connected, technology-enabled, and patient-centered model in the years ahead.

About dakota

Dakota is a financial, software, data and media company based in Philadelphia, PA. Dakota’s flagship product, Dakota Marketplace, is a database of LPs, GPs, Private Companies and Public Companies used by thousands of fundraising, deal, and investment teams worldwide to raise capital, source deals, track peers, and access comprehensive data, all in one global platform. For more information, book a demo of Dakota Marketplace!