The SBIC program is a cornerstone of U.S. private capital, blending SBA leverage with private investment to back lower middle-market businesses, the backbone of the economy. Structured as pass-through entities, SBICs offer tax advantages, CRA credit, and fewer regulatory hurdles, while providing flexible financing for founder-led, family-owned, and underserved companies often missed by traditional PE and credit markets.

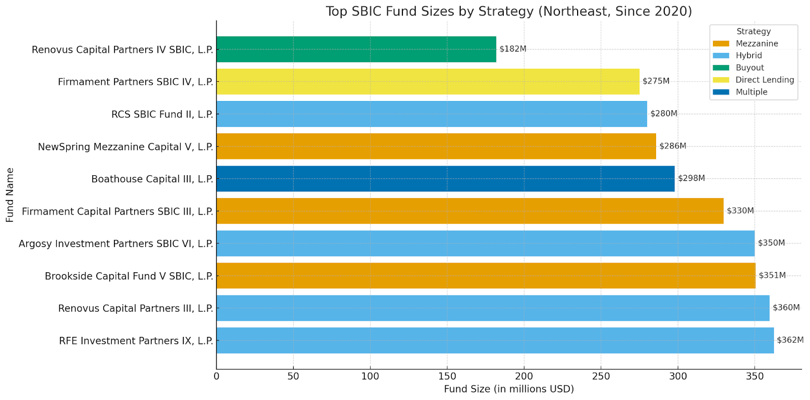

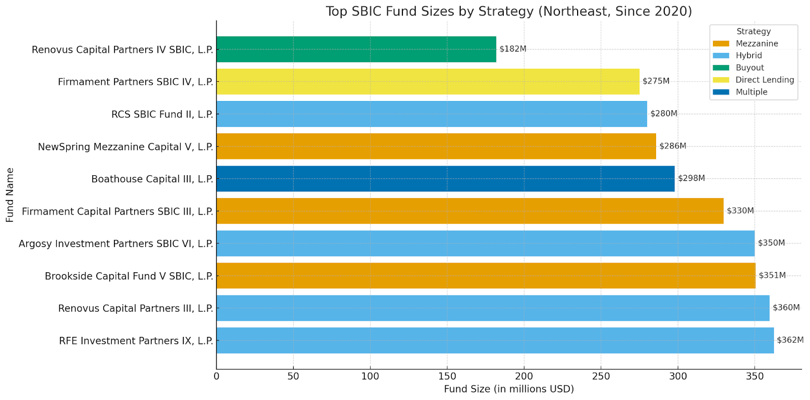

In this paper, we explore the top ten SBIC funds in the Northeast launched since 2020, highlighting their strategies, trends shaping the market, and key takeaways for GPs and LPs.

Funds

1. Renovus Capital Partners III, L.P. – Wayne, PA | 2021 | $359.5M | Avg. $6.1M | Hybrid Debt/Equity | Hybrid | New investments: Yes | Contact: Bradley Whitman

2. RFE Investment Partners IX, L.P. – Westport, CT | 2020 | $362.3M | Avg. $2.6M | Hybrid Debt/Equity | Hybrid | New investments: Yes | Contact: James Parsons

3. Brookside Capital Fund V SBIC, L.P. – Stamford, CT | 2024 | $350.6M | Avg. $3.5M | Mezzanine | Private Credit | New investments: Yes | Contact: Corey Sclar

4. Argosy Investment Partners SBIC VI, L.P. – Wayne, PA | 2021 | $350.0M | Avg. $10.7M | Hybrid Debt/Equity | Hybrid | New investments: Yes | Contact: Michael R. Bailey

5. Firmament Capital Partners SBIC III, L.P. – New York, NY | 2020 | $329.7M | Avg. $5.5M | Mezzanine | Hybrid | New investments: Yes | Contact: Christopher D. Smith

6. Firmament Partners SBIC IV, L.P. – New York, NY | 2023 | $275.0M | Avg. $10.8M | Direct Lending | Private Credit | New investments: Yes | Contact: Christopher Smith

7. RCS SBIC Fund II, L.P. – Boston, MA | 2021 | $280.0M | Avg. $7.3M | Hybrid Debt/Equity | Private Credit | New investments: Yes | Contact: Doug England

8. NewSpring Mezzanine Capital V, L.P. – Radnor, PA | 2023 | $285.8M | Avg. $5.4M | Mezzanine | Hybrid | New investments: Yes | Contact: Anne Vazquez

9. Boathouse Capital III, L.P. – Wayne, PA | 2021 | $298.0M | Avg. $4.7M | Multiple | Hybrid | New investments: Yes | Contact: Brian Adamsky

10. Renovus Capital Partners IV SBIC, L.P. – Wayne, PA | 2024 | $182.0M | Avg. $6.1M | Buyout | Private Equity | New investments: Yes | Contact: Jean Tucker

Ranked Insights for GPs

-

Strategy Differentiation – Most are hybrid/mezzanine. Clear positioning in structure (flexible hybrid, niche mezzanine, targeted lending) is critical.

-

Repeatability & Track Record – Multi-vintage consistency (Renovus, Argosy, Firmament) is rewarded. Show franchise progression beyond Fund I.

-

Deal Size Specialization – Ranges span $2.6M–$10.7M. Each GP has a clear band. Define your “sweet spot” early.

-

Ecosystem & Geography – Strong hubs in Philadelphia/Wayne, CT, and NY. Being near clusters builds credibility. Outside them, emphasize sector/region focus.

-

Capital Formation & Scaling – Most successful funds are $275M–$360M. Launch smaller (e.g., $100M–$150M) with a roadmap to scale.

-

SBA-Driven LP Advantages – CRA/tax/reg benefits apply to all SBICs. Use as a supporting point, not main differentiator.

SBA, SEC, and Congressional Developments

SBA Changes

-

IDG Rule in Effect: Introduced Accrual Debentures (equity-focused) and Reinvestor Debentures (fund-of-funds), aligning SBICs with modern private capital strategies.

-

Proposed Amendments: Streamlined licensing for follow-on funds and reduced barriers for investments in strategic sectors (e.g., critical minerals, tech).

Congressional Legislation

-

Expanded Accredited Investor Definition: Bills like the Fair Investment Opportunities for Professional Experts Act would allow accreditation based on certifications or knowledge exams, expanding the LP pool.

-

Investing in Main Street Act: Raises bank SBIC investment caps from 5% → 15% of capital, unlocking billions in new institutional capital.

-

Investing in All of America Act: Incentivizes SBICs to invest in rural/low-income areas by exempting those deals from leverage caps.

SEC Changes

-

Private Fund Rules: New reporting and disclosure requirements (fees, expenses, performance) increase compliance burdens for private fund advisors.

-

Retail Access: SEC guidance removed the 15% cap on closed-end fund allocations to private funds, signaling greater openness to retail participation.

Conclusion

The SBIC landscape is shifting rapidly. SBA reforms are adding structural flexibility, Congress is considering measures that could unlock new capital and direct it to underserved sectors, and the SEC is lowering barriers to retail participation while raising transparency standards.

For GPs, success will hinge on clear strategy and disciplined fund progression; for LPs, broader access will come with higher due diligence demands. Together, these changes reinforce the SBIC program’s role as a vital bridge between policy priorities and private market innovation.