Scale Meets Strategy

Welcome back for round two. Headlines this month were less about splashy team stakes but still packed a punch. Major investors doubled down on sports as a growth engine, and technology pushed new frontiers in how performance, data, and fan engagement create value.

Capital & Consolidation

Endeavor Group and TKO Group CEO Ari Emanuel launched MARI with assets that include IMG's portfolio of tennis events. Backed by a roster including RedBird, Ares, QIA, the Miami Dolphins ownership group, and other big names, it’s a who’s who of sports investors wagering on live events as the next frontier in scalable media and experience platforms.

Elsewhere, CVC is in talks with Ares and others to restructure debt across its $13B+ Global Sports Group, and Goldman Sachs’ bid for Excel Sports Management extends Wall Street’s reach deeper into athlete representation.

The Big Ten’s proposed $2B partnership with CalPERS could make a public pension fund an equity holder in college sports – an unprecedented step blending governance and private capital.

Football (dba Soccer) Investment Matures

According to Football Benchmark, the European football M&A market has entered a more strategic phase. Through October 2025, 76 club transactions were recorded, with over half involving US investors. The mix is shifting, with fewer headline buyouts and more minority stakes, portfolio integrations, and multi-club ownership models.

Innovation Fueling Infrastructure

Sony’s integration of STATSports, Hudl’s acquisition of Athletic Data Innovations, and Catapult’s soccer analytics expansion in Europe mark a race toward unified performance platforms. The trend accelerated further with Exos’ acquisition of Infinite Athlete and Biocore, a deal backed by BDT & MSD Partners and Madrone Capital Partners, combining biomechanics, AI, and data science to redefine human performance and athlete safety.

Meanwhile, startups like Jabbr, Ankored, and CourtReserve show how AI and automation are filtering from elite to recreational levels and reshaping everything from compliance to coaching.

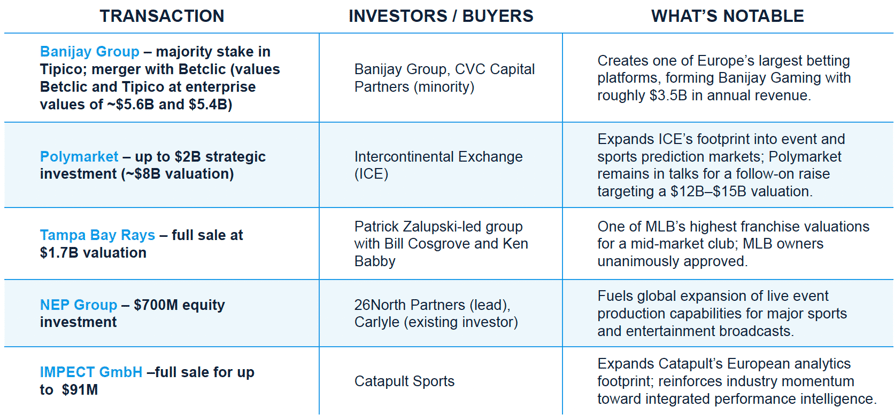

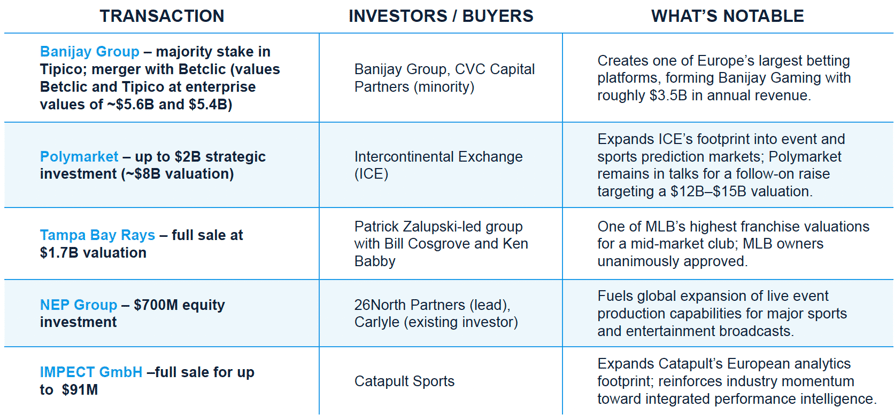

Top 5 Deals of the Month

In Focus

A closer look at the forces shaping sports capital

Building the New Betting Economy

Just a few years ago, legalized sports betting was the “next big thing” – a frontier promising billions for operators, leagues, and media giants. Now, the US market is in full stride. According to Legal Sports Report, the industry is on pace for a record $164B in handle this year – up nearly 10% from 2024 – with operator revenue projected to rise 17% to $16B.

The first wave of growth focused on market access and state-by-state legalization. The next is broader: betting as infrastructure, media engine, and financial product.

Scale, Consolidation, and Control

At the top of the pyramid, Flutter Entertainment’s $1.8B buyout of Boyd Gaming’s 5% stake in market leader FanDuel shows how scale drives profitability. The deal takes Flutter’s ownership to 100%, while cutting long-term market-access costs by about $65M annually.

Financed through a bridge loan, the deal shows investors will tolerate leverage when growth visibility is strong and regulatory risk low, and FanDuel’s $31B valuation underscores how much they prize engagement and brand equity.

Consolidation provides a playbook: betting platforms are evolving into media ecosystems that monetize predictive data, streaming, and social interaction. In short, the opportunity lies not only in the wagers themselves but in the monetization of attention – the audience betting creates.

Betting and Media Infrastructure

That audience dynamic now powers sports media. Sports financier Sal Galatioto, president of Galatioto Sports Partners, put it succinctly on a recent episode of the Compound Insights podcast:

“We’ve seen what happened in the EPL when gambling was legalized – ratings went up and up. Why? Because people weren’t just watching their favorite team; they were watching every team they put money on.”

And the more they watch, the more information they want. That hunger for real-time data and predictive insight is now a core growth engine for sports media and betting platforms alike. In October, Winners Inc. acquired Moneyline Sports, a Nevada-based AI analytics firm that develops predictive sports analytics, tailors insights, and automates fan interaction.

This “betting halo” effect explains why DAZN, the streaming platform backed by Leonard Blavatnik, has placed sports wagering at the center of its model. After more than $7B in capital – including a recently disclosed $587M injection – DAZN is expanding its rights portfolio and layering in interactive betting and prediction tools to drive engagement. Losses narrowed from $2.3B in 2021 to $936M last year, and DAZN now projects profitability in 2026, targeting $5B in revenue through expanded coverage and advertising.

As Galatioto noted, “People are starting to watch games they have no rooting interest in because they’re wagering on them. And as long as they’re watching, that’s value to advertisers.” That same engagement logic is reshaping strategy across media. M+C Saatchi’s acquisition of the Women’s Sports Group (WSG) – the UK-based rights consultancy behind the Women’s Super League’s broadcast deals with Sky Sports and BBC – highlights how audience value is reshaping media strategy. WSG helps leagues and networks build commercial models around attention, storytelling, and participation. And yes, DAZN happens to be one of its clients.

Prediction Markets and the Regulatory Reckoning

The next frontier extends beyond sportsbooks. In October, the NHL announced a first-of-its-kind licensing partnership with prediction-market operators Kalshi and Polymarket, granting access to official league data and logos – effectively legitimizing prediction markets within major U.S. sports.

Kalshi CEO Tarek Mansour called it a “seminal moment,” suggesting it could pave the way for other leagues, while the NHL viewed it as a means to reach new audiences through speculation and fandom.

DraftKings made its own move into the space, reportedly agreeing to acquire Railbird Exchange for up to $250M. The deal includes a $50M upfront payment and up to $200M in performance-based incentives.

The timing is striking. Kalshi – which recently raised $300M at a $5B valuation – has reportedly drawn takeover interest valuing it at over $10B. Polymarket, meanwhile, is in the midst of a $2B investment from Intercontinental Exchange (ICE) and plans to relaunch in the US after a two-year absence. In a notable linkage, Polymarket Clearing will act as the designated clearinghouse for DraftKings, formalizing the crossover between traditional sportsbooks and decentralized prediction infrastructure.

But these advancements have faced pushback. Kalshi recently sued the New York State Gaming Commission after a cease-and-desist order accused it of offering unlicensed sports betting. The case joins a growing list of state-level clashes with mixed rulings.

These legal battles show that innovation in wagering is outpacing regulation. Prediction markets sit in a gray zone between entertainment and finance, and their future depends on how regulators classify them.

Regulation may be lagging, but money rarely does. Sharp Alpha Advisors raised $150M for its User Acquisition Fund – which backs online gaming, prediction markets, sports media, ecommerce, health & wellness, and interactive entertainment. Founder Lloyd Danzig calls the firm’s “cohort-based financing” model a way to align capital deployment directly with customer outcomes, scaling with company growth while preserving ownership.

From Speculation to System

Betting, data, and media are converging into one ecosystem where attention is the currency and infrastructure the moat. They say the house always wins, but the surest winners could end up being those building the systems that let the house run.

Capital Roster

More than endorsements: athletes shaping the business of sports

Ownership & Investments:

Chicago Bears quarterback Caleb Williams joined the investor group for the new NWSL franchise Boston Legacy FC, alongside WNBA star Aliyah Boston, gold medal gymnast Aly Raisman, and Boston Celtics GM Brad Stevens, reinforcing the surge of athlete-backed women’s sports ownership.

Pop star muse and tight end Travis Kelce joined activist hedge fund JANA Partners in its 9% stake in Six Flags Entertainment, aiming to overhaul the theme park operator’s strategy and guest experience.

Five-a-side soccer competition The Icon League, co-founded by retired German soccer star Toni Kroos and Elias Nerlich, raised €15M ($17.3M) in a Series A led by HV Capital, with participation from Jürgen Klopp’s family office and Luigi Berlusconi’s H14.

Advisory & Platform Roles:

NFL legend Drew Brees deepened his operational footprint as Unrivaled Sports acquired his youth league, Football ‘N’ America (FNA), integrating it into a national flag football framework where Brees will help shape strategy and programming.

Former Warriors GM Bob Myers will become president of Sports at Harris Blitzer Sports & Entertainment, overseeing strategy across the 76ers, Devils, Crystal Palace F.C., and Joe Gibbs Racing. The move relieves (pun intended) Myers of his duties of trading takes with Kendrick Perkins on ESPN, extends HBSE’s multi-club model, and reinforces the trend of elite operators shaping institutional sports ownership.

Beyond the Big Leagues

Where passion meets portfolio: investments in the sports you already play

Are we going to need a padel and pickleball newsletter spinoff? Those sports remain the heartbeat of the play-to-invest movement, with software and operating platforms attracting institutional attention alongside the grassroots enthusiasm.

Deals to Know:

- Fairgrounds, the Canadian racquet club operator, closed a Series A round led by Back Forty to fund seven new pickleball and padel clubs across the country.

- CourtReserve secured a $54M strategic growth investment from Mainsail Partners to accelerate its AI-powered platform for racquet and paddle facilities, already used by 2,000 clubs and five million players worldwide.

- Oakley Capital invested £9M in Barcelona-based padel brand NOX to fuel international growth across the US and Asia and explore the fast-emerging pickleball market.

- Frontier Growth led an $8M Series A for PodPlay, a venue-management software startup spun out from PingPod, extending automation and video tools to participatory sports like padel and table tennis.

- Centre Court Capital led a $2.5M pre-Series A round for Michezo Sports, a Bengaluru-based sports infrastructure startup focused on building and modernizing community facilities across India.

- Wonder Franchises acquired community-soccer operator Soccer 5 USA, with plans to scale its small-sided facility model across the Southeast and beyond.

Trendlines to Watch:

Oakley’s global bet on NOX, Mainsail’s backing of CourtReserve, and Centre Court’s push into Indian infrastructure show that participation-based sports are evolving into scalable platforms. Whether through tech integration, real estate development, or franchise expansion, investors are treating community recreation as a durable asset class.

On Deck

Tracking the next moves in sports capital

- Big Ten’s $2B Play Under Review: The conference’s proposed private capital partnership with CalPERS and other institutional investors faces pushback from Michigan and USC trustees, who question long-term control and equity implications. The outcome could set a defining precedent for college sports finance.

- Real Madrid Restructure on Deck: The club is considering major governance changes to allow external investment for the first time in its 121-year history. Advisors from Key Capital Partners and Clifford Chance are evaluating options that could open the door to private equity while preserving member control.

- Seattle Sounders Seek Strategic Investment: MLS club Seattle Sounders FC hired Moelis & Co. to explore an outside investment valued around $825M to fund a new soccer-specific stadium and redevelop its HQ. The move marks the team’s first search for a major partner since 2009. as it plans for life beyond its Lumen Field lease expiring in 2032.