April public pension plan commitment summary points:

- Noise around regional and local banks continued to be in the headlines as another notable bank was placed into receivership and swiftly absorbed.

- Lending conditions via the traditional credit/banking system continued to tighten, which has been a goal of the Fed. This however is a benefit to the private credit/debt asset class as these managers are able to fill this void. In turn allocators are entering the asset class at more attractive prices VS a year ago.

- With many asset classes experiencing less volatility outside of financials, the funding level of the top 100 pension funds continued to improve ending at 74.5% VS 73% a month ago according to Milliman.

April was slower across the 80 individual commitments made totaling $6.4 B allocated among 60 individual managers. There were no terminations and 29 individual pension funds made commitments during the month.

The top allocations during the month were:

- Virginia Retirement System allocating $1.575 billion

- LA County Employees Retirement Association allocating $600 million

- NY State Common allocating $600 million

Asset Classes- April’s allocations were allocated more evenly VS other month with Private Equity taking in 34% of commitments, Private Credit rising to second with 24% of commitments, and Real Assets back into the top three taking 21% of commitments. This was the lowest amount allocated to Private Real Estate in over 14 months, due mainly to the large commitments made during 2021-2022 and cap calls being made as we speak.

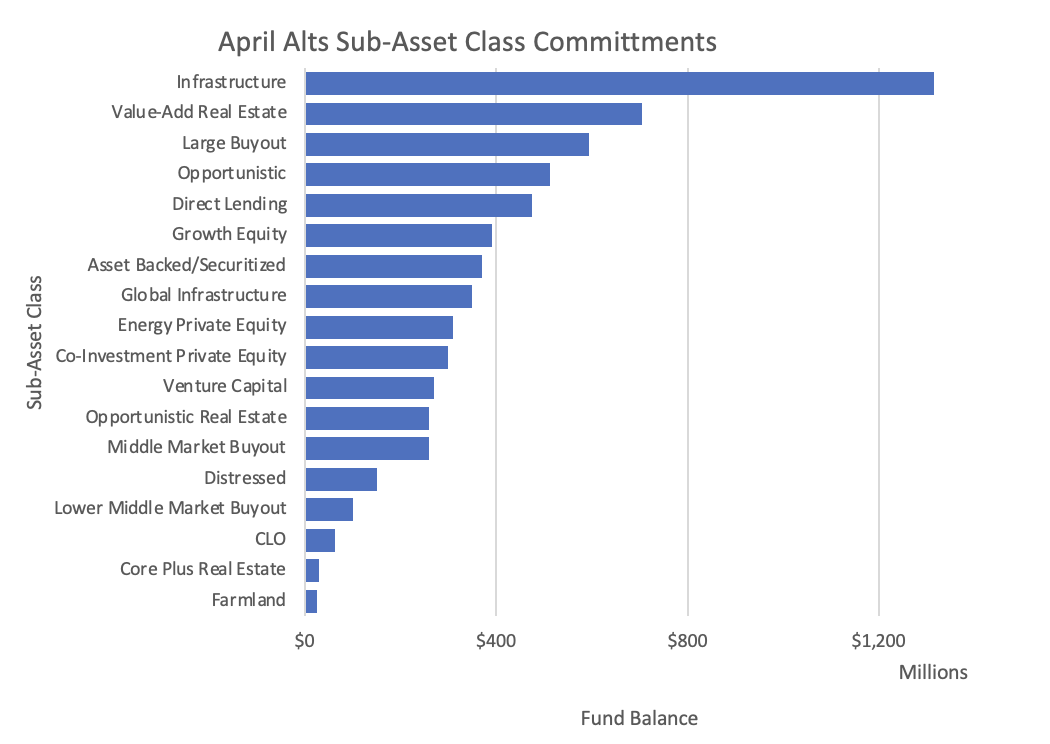

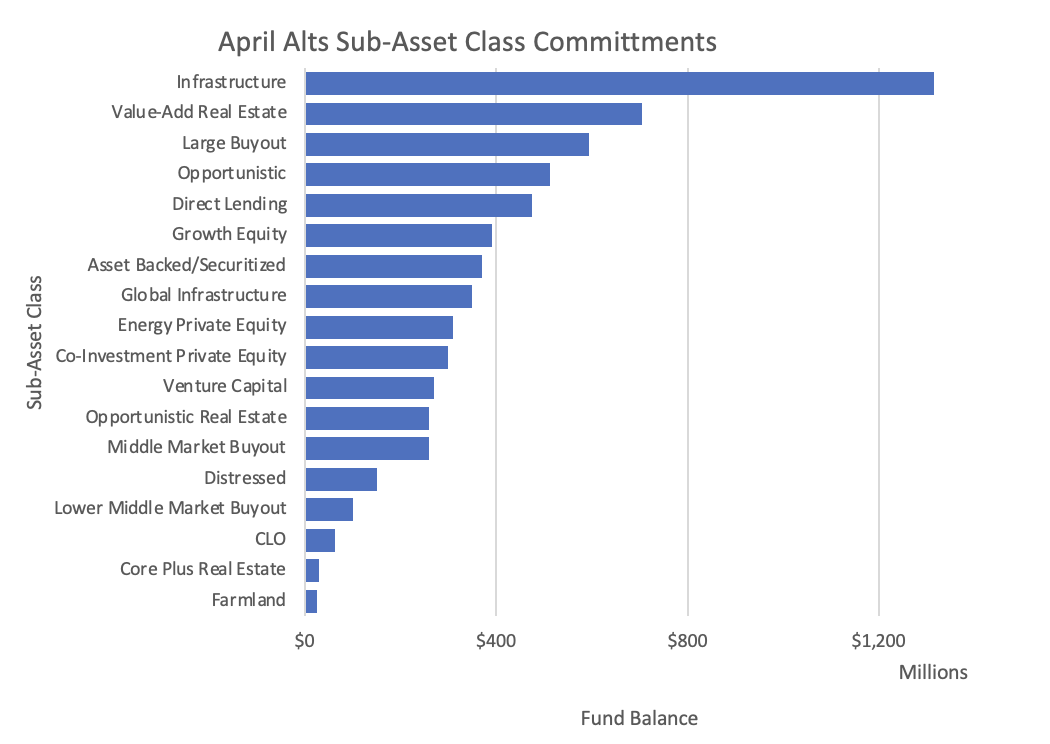

Sub Asset Classes-Infrastructure was by far the largest sub-asset allocation taking in 20% of commitments, in second Value-Add Real Estate took in 10% of allocations, and P/E Large Buyout took in 9% of commitments in third place. Completely reversing the trend we saw last month, this was one of the narrowest of sub-asset classes allocated to with only 18 being allocated to.

Looking at the top shifts made this month:

- Virginia Retirement System allocated $350 M to the Pantheon Global Infrastructure Fund III, $300 M to the Hellman & Friedman Capital Partners XI large buyout fund, and $250 the recently launched Ares Pathfinder II private credit fund. VRS had focused on infrastructure and direct lending as the main sub-asset classes.

- LACERA had one large allocation of $600 M to the Macquarie Global Infrastructure Fund. Macquarie and Brookfield have been consistent recipients of infrastructure commitments for the past trailing 12 months.

- New York State Common Retirement Fund allocated $300M to Hudson River Co-Investment Fund IV and another $300 M to Cortland Enhanced Value Fund VI ( value add real estate

- Last month we mentioned that a few CLO mandates were made in well over a year, and this month these allocations continue to drip into the CLO sub-asset class. While the floating rate asset class typically sees retail inflows ahead of rate hiking periods and then a rotation back out just as fast, pensions often allocate based on the capital stack preference and duration management.

For more investment insights on Public Plan Commitments and other information, register for the Dakota Live! Call.