The month of May saw:

- Subdued markets in May led to a small increase in funded status from 74.5% to 74.8% according to Milliman.

- The biggest observation has been less volatility across fixed income sub-asset classes and guessing where monetary policy may go.

- As we noted last month, tighter lending conditions via the banks have now opened opportunities for private credit and private real estate lending to step in as many managers have been purchasing these loans at attractive levels from the banks.

May was a meaningfully busier month as commitments made totaled $15.6 B allocated among 109 individual managers. There were no terminations and 48 individual pension funds made commitments during the month.

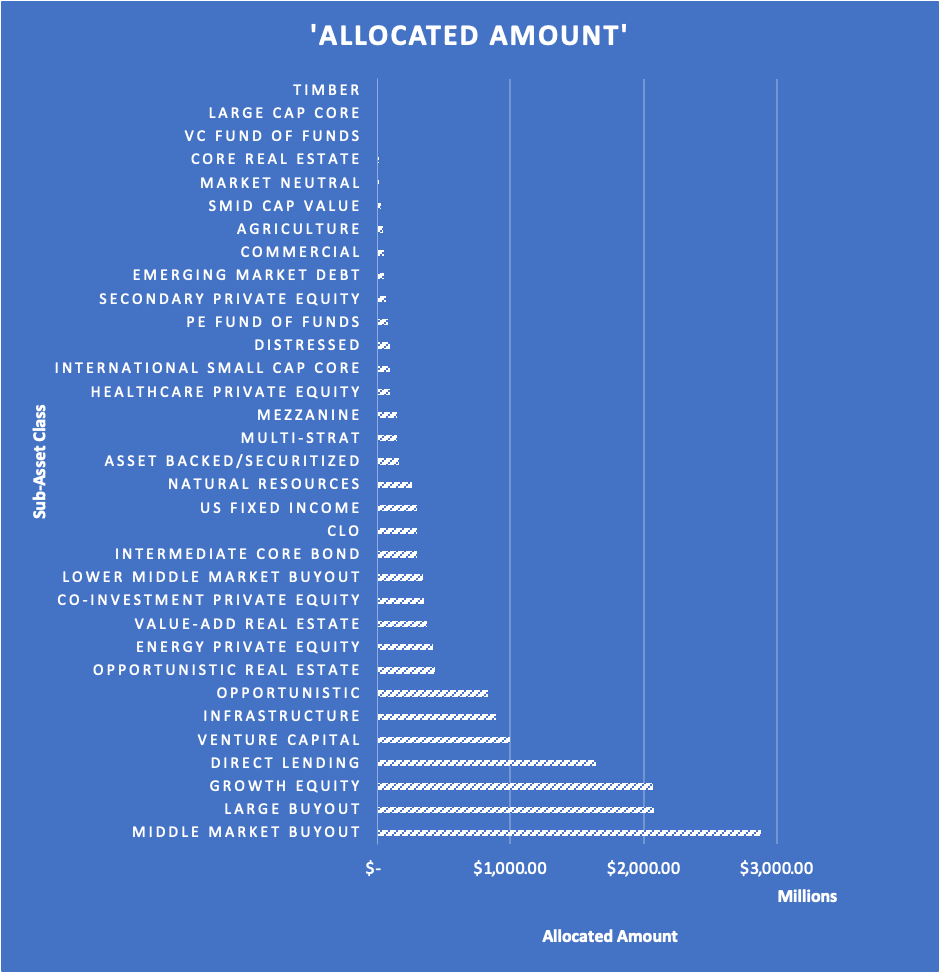

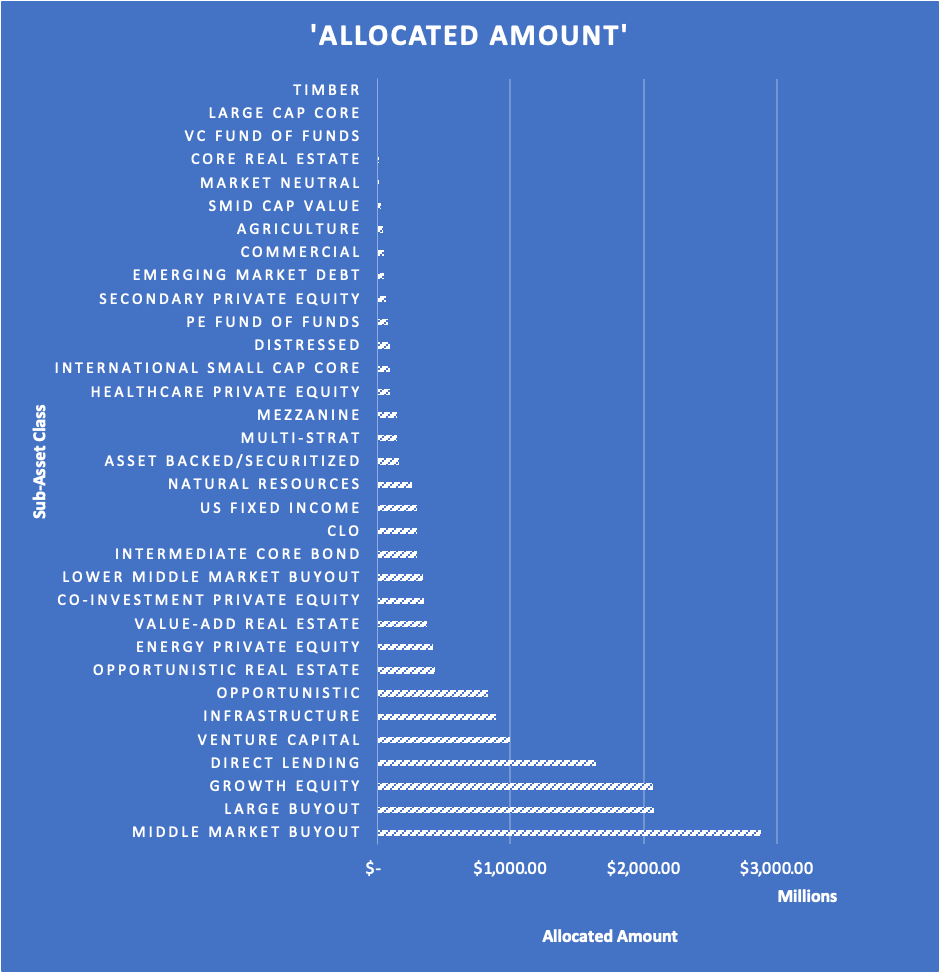

The top allocations during the month were:

- Washington State Investment Board allocating $2.5 billion

- Florida State Board of Administration allocating $1.7 billion

- New Jersey Division of Investment allocating $1.275 billion

- Indiana Public Retirement System allocating $1.235 billion

Asset Classes: May was an about face in terms of where allocators committed capital with Private Equity taking in 60% of commitments, Private Credit maintained second with 20% of commitments, and Real Assets also maintained its spot in the top three taking 7% of commitments. It is also worth mentioning that Fixed Income took in 4% this month, a reflection of the higher yields present today VS a year ago.

Sub Asset Classes: flowing down from PE being the largest asset class, Middle Market Buyout the largest sub-asset allocation taking in 18% of commitments, in second Large Buyout took in 14% of allocations, and Growth Equity also took in 14% of commitments in third place. Worth a mention that the Direct Lending sub-asset class came into the top five for the first time in a year it is taking the place of traditional lending sources. While we sound like a broken record, VC maintains a spot also in the top five, as the allocators remain committed to innovation and growth deposit what we are reading in the headlines. There were over 33 sub-asset classes allocated to this month, which is higher than average.

Looking at the top shifts made this month:

- Washington State Investment Board allocated $750 M to the Hellman & Friedman Capital Partners XI (11) large buyout fund, another $750 M to the TA XV ( 15) growth equity buyout fund, and $400 M to the Searchlight Capital IV middle market buyout.

- Florida State Board of Administration allocated $300 M to Loomis Core Plus Fixed Income and another $300 M to Manulife Core Plus Fixed Income confirming that pension allocators are more comfortable adding traditional Agg exposure again, and lastly $200M to Sprott Private Resource Lending III and another $200 M H.I.G. White Horse FSBA both of which are Direct Lending funds.

- New Jersey Division of Investment allocated $350M to HPS Investment Partners direct lending SMA, $250 M to CVC Capital Partners IX large buyout, and another $200 M to HPS Investment Partners Co-Invest direct lending fund.

- One item of note is that we continue to see the Hedge Fund asset class struggle to attract allocations this year. But as allocators continue to tell us during the Dakota Live segments, always stay in front of allocators with ideas so when the market turns another direction, they are familiar with your strategy. CLOs are a great example of this as a year ago the segment failed to attract interest yet in 2023 is in the top 10 each month now.