With the 4th quarter 13F filing window now closed, MarketPlace was tracking 3330 ETFs from 278 sponsors via the filings. For 2022 this amounts to over 219,000 individual positions which are linked to an allocator inside of MarketPlace.

Some stats at the end of the quarter and all of 2022 which caught our attention:

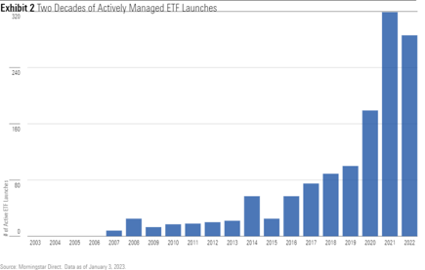

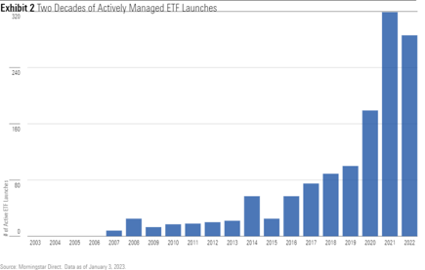

- 421 ETFs have launched in 2022, about 9% fewer than last year. Of these funds, 296 or 70% of these were actively managed ETFs, rather than passive or index tracking approaches.

- Some stats on the asset classes launched:

- High level asset class: 37% of new launches in 2022 were equity, and 22% were fixed income related

- Equity large core 46 funds

- High yield bond 23 funds

- Leveraged/trading equity 23 funds

- Tech sector equity with 22 funds, something we have not seen in a while in being sector specific.

- 36 funds were launches with an ESG focus or bend, the majority actively managed.

- 2022 saw fund closures almost double from last year going to 145 ETFs liquidating, against 79 in 2021. The majority of these were niche, thematic strategies which had not added alpha over the passive alternatives, and simply did not attract assets as a result ie applying multi-factor to just a financial sector ETF was too narrow for many allocators.

- Blackrock/iShares rolled out more ETFs than any other issuer launching a total of 20 ETFs, and BondBloxx, a newer manager that focuses on fixed income, launched its first products in 2022 and came in second with 19 ETFs and roughly $540 million in assets under management.

- Nine active-non/semitransparent ETFs came to market in 2022, with a total of 55 now outstanding. This overlay was expected to be very popular among managers wishing to have their trades somewhat hidden, but acceptance continues to lag in real world usage.

- The universe of actively managed strategies continues to grow as there are now 1,005 actively managed ETFs, approximately 30% of all ETFs are actively managed, which include another 17 mutual funds which converted to active ETFs during 2022.

- Flow wise, interesting to note that the top 10 newly launched ETF gathering assets in 2022, all were equity based.

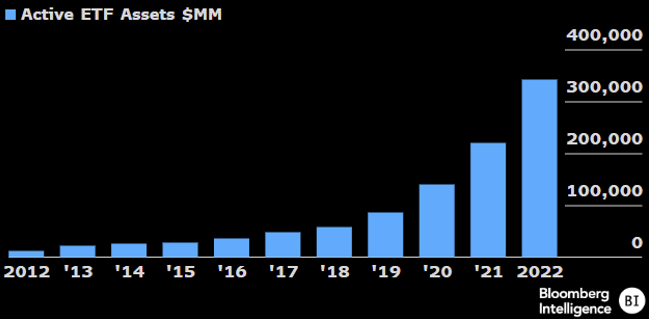

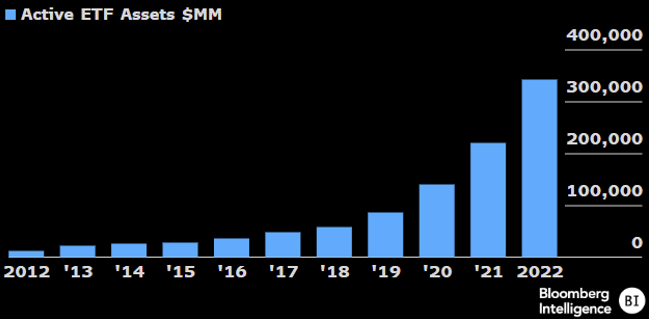

- Active ETFs took 14% of inflows, but are still less than 4% of total ETF assets.

- For the full year, almost $87 billion went into actively managed ETFs. Under the hood however we saw almost half go to ETFs from DFA, American Century, JP Morgan AM and Capital Group. 14% of inflows despite comprising less than 4% of total ETF assets

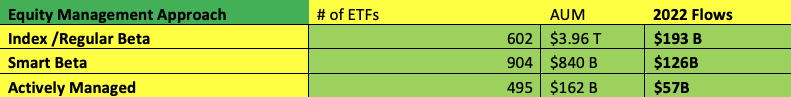

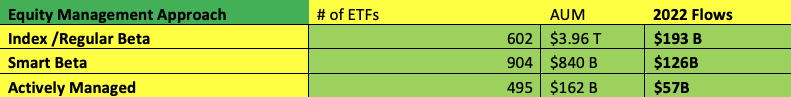

Equity Approaches: passive, smart beta, active? While all three categories received positive net flows in 2022 allocators are fueling more organic growth via the smart beta and active approaches.

The Dividend factor took in over half of smart beta flows at $67 B in as allocators sought income/cash flow from their equities, with buffered “defined outcome “coming in second at $10 B in flows. These buffered ETFs allow an easy way for an allocator to introduce hedging to portfolios without handling individual options which are hard to scale across multiple clients and risk tolerances.

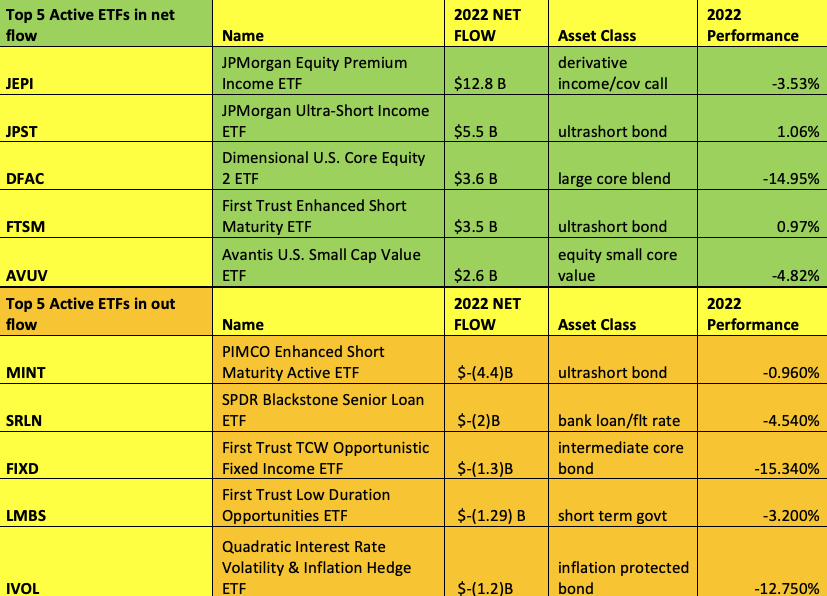

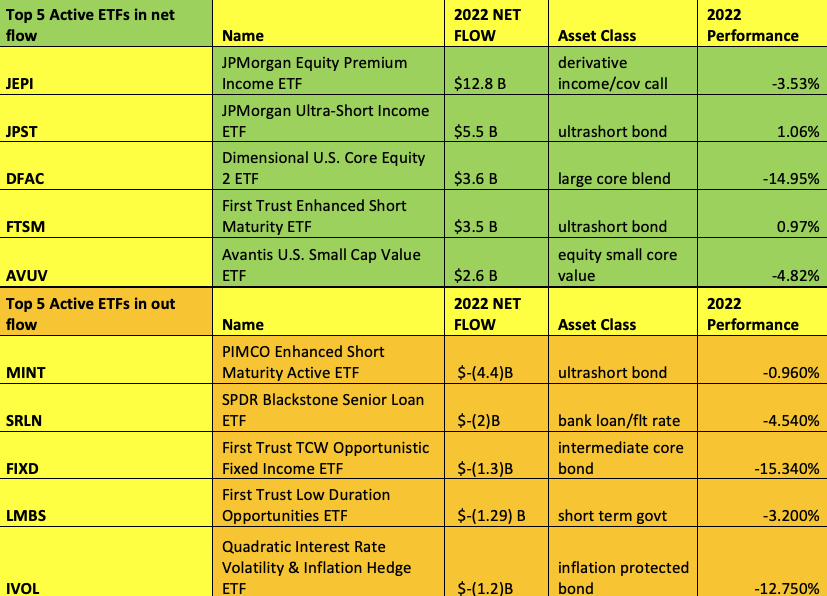

Looking at the top five active ETF in-flows in 2022 on an individual issue basis, they had a yield focus either with dividends, options overlay, or positioning on the yield curve to capture fixed income yield. The top five induvial active ETFs for out-flows had two themes in common:

- Where the Fed is and potential impact on the credit cycle drove redemptions out of lower quality fixed income.

- Losses across the bulk of the fixed income market allowed allocators to harvest losses in fixed income ETFs where duration had impacted performance and lock in losses, something which has not occurred in years for fixed income.

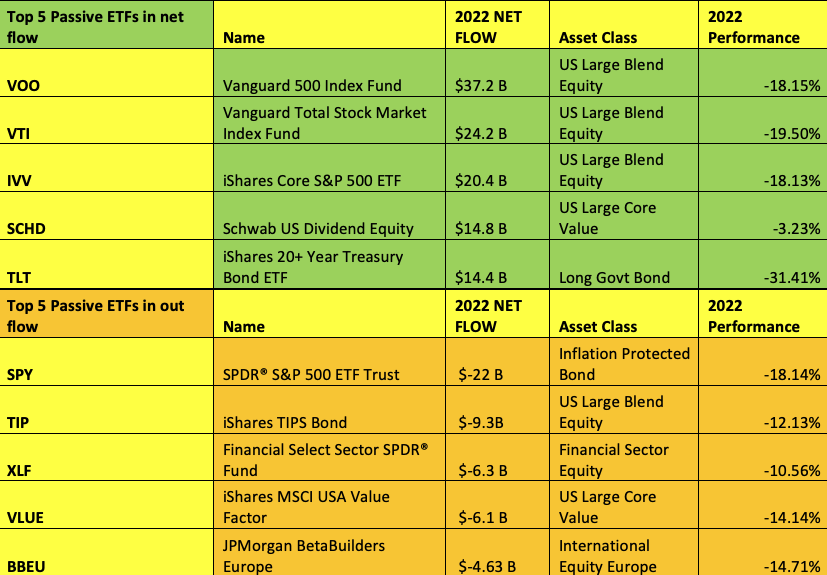

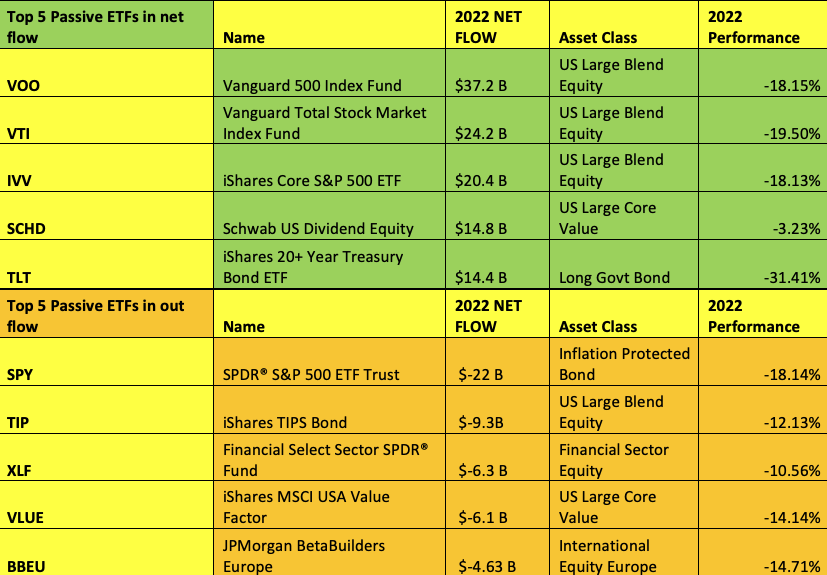

Shifting to the top 5 passive ETF in-flows and out-flows in 2022 on an individual issue basis, at first glance it appears allocators just swapped one ticker/cusip for another to capture the tax-loss but maintained exposure to that sub-asset class with two key differences:

- Shifting from the TIP/inflation ETF to TLT 20+ Treasury ETF was a sign that allocators felt that inflation was peaking and long-term government bonds were now attractive.

- Shifting from the iShares MSCI USA Value Factor into the Schwab Dividend ETF showed that allocators were not selling value equities in all, but sharpening their focus to strategies where dividends were the major factor.

Three ETF launches of 2022 which stood out to us during the year:

- The Meet Kevin Pricing Power ETF- “PP”

- Fairlead Tactical Sector-“TACK”

- BTD Capital Fund- “DIP”

For more information and to view the full library of past Dakota Live! Calls, we'd love to offer you a free trial of Dakota Marketplace!