For the first time in over a year, the capital markets treated allocators well in both fixed income and equities, despite the banking specific volatility which the Fed and Treasury acted swiftly to contain in Q1 2023. This allowed allocators to take advantage of the valuation resets we have seen occur since this time last year and we saw that in flows and ETF product creation.

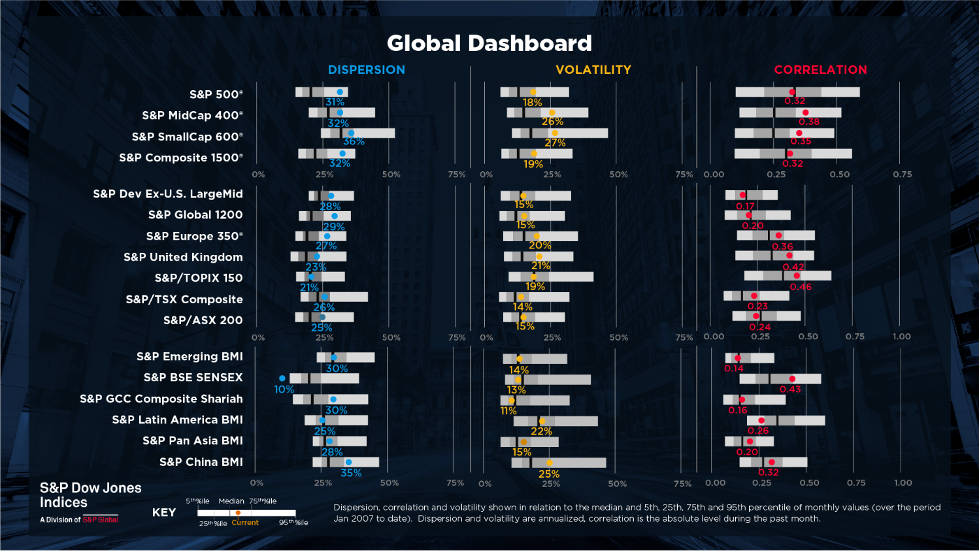

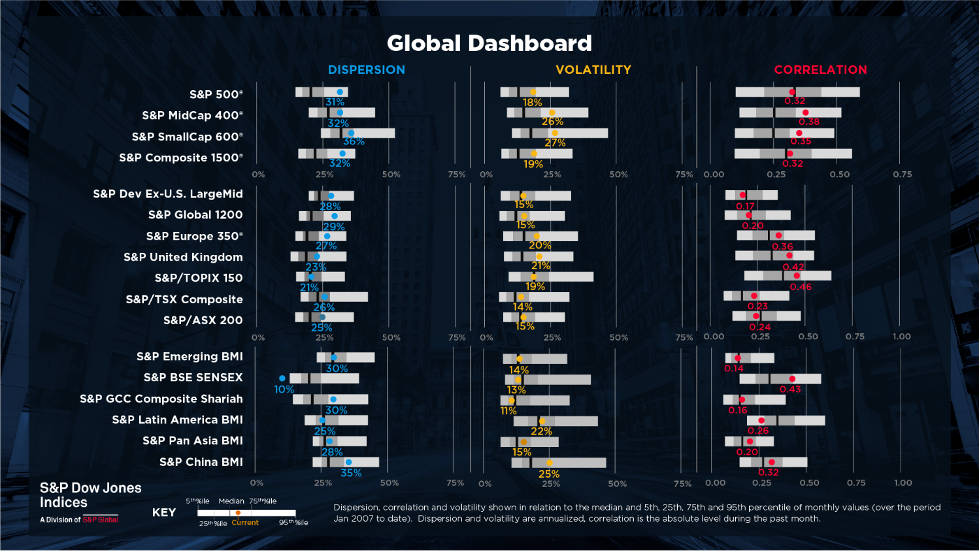

Another positive development that occurred was a higher level of dispersion among all sub-asset classes of equities. An example of this was the tech sector ETF up 19% during the quarter VS the financial sector ETF down -7%. The higher level of dispersion during the quarter led to allocators using more sector specific ETFs and increased flows to active ETF strategies as stock picking VS index picking has begun to add alpha again.

While the ETFs continue to attract net new flows VS mutual funds, equity ETFs still represent only 14% of the equity market and only 2.8% of the bond market from an AUM perspective. Looking at turnover however, trading volume as a percentage of total U.S. equity volume reached nearly 40% via ETFs during the quarter. Fixed income trading also increased 13% VS last quarter, as record flows came into bonds due to higher yields available and does not appear to be slowing. Part of what fed into bond ETFs attracting flows, pulling deposits away from banks, is that real interest rates are above inflation now, and that is drawing money away from traditional savings accounts into fixed income.

US ETF stats at the end of Q1 2023:

- YTD net inflows of $81 B are the fourth highest on record

- 11th month of consecutive net inflows.

- Assets of $6.90 Tn invested in ETFs and ETPs listed in US at the end of Q1

- ETF AUM increased 6.1% in Q1 2023, going from $6.51 T at end of 2022 to $6.90 T

At the close of Q1, MarketPlace was tracking 3340 ETFs from 297 individual asset managers sponsors via the 13F filings. For the quarter this amounts to over 350k individual positions which are linked to an allocator inside of MarketPlace

This is a net increase of 30 new ETF managers/sponsors, however only net new 12 ETFs VS the last quarter of 2023 due to closures and a reminder that an exchange has the right to kick off ETFs that do not maintain minimum volume and liquidity requirements.

Looking fund closures, these are up 200% YoY as 58 ETFs have liquidated in Q1 as allocators have become more selective in how they deploy cash…especially now that cash is an asset class again. Many of the closures took place in the thematic, digital crypto, and SPAC based area as asset managers rationalized their lineups.

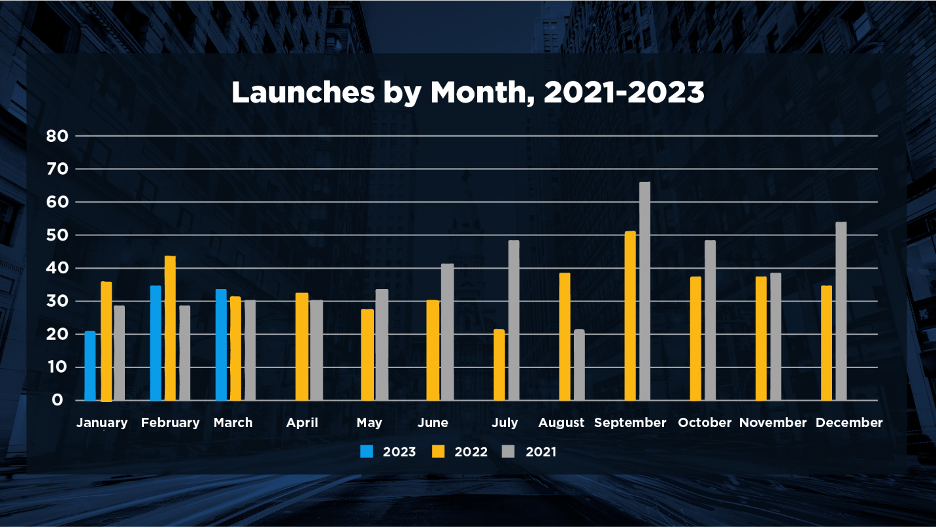

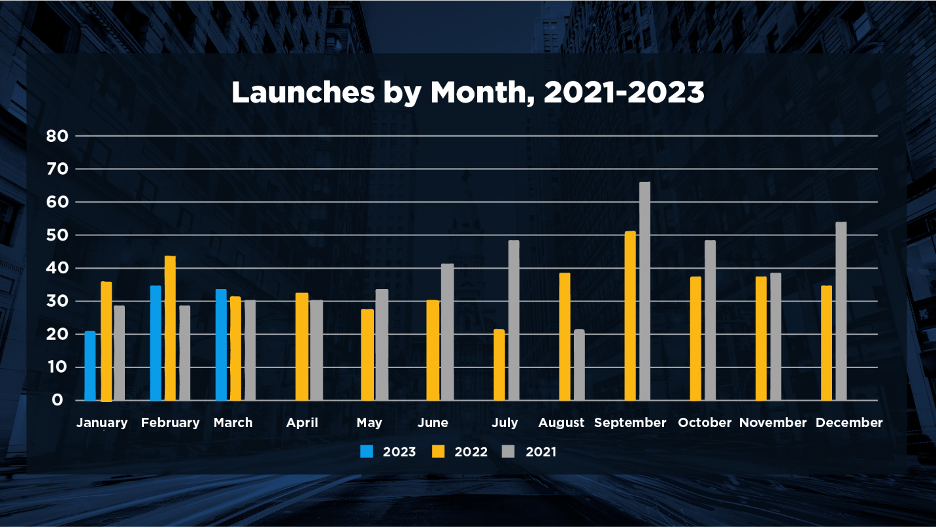

Launches are down slightly during Q1 at 20% YoY with 94 new ETFs coming to market. There was a noticeable drop in ESG themed ETFs with 58 coming to market VS 101 during the same time last year. Higher expense ratios and political headlines have created a headwind to sustained interest.

Some stats on the asset classes and sub-asset classes launched:

- Equity large core 14 funds, third quarter in a row in the top issuance

- Options /buffered 12 funds, these are now consistently issued as many have monthly expirations and have become popular hedges

- Materials/commodity 6 fund, Sprott launched a series a metals linked ETFs tied to EV and other high value minerals

- Ultrashort Investment Grade 5 funds, taking advantage of higher front end bond yields

- 61 of 94 launched funds were actively managed, with only 5 using an ANT (active non-transparent wrapper. The ANT wrapper continues to struggle because major broker-dealers have been slow to add them to their platforms.

- 19 funds are ESG themed or focused

- 2 Smart Beta funds were launched, the lowest in over 4 years.

The universe of actively managed strategies continues to grow as there are now 1,113 actively managed ETFs. Q1 saw inflows into actively managed ETFs meaningfully take share at 33% of ETF net new money with JPMorgan and DFA taking the majority of the flow.

All major active ETF asset classes saw net inflows except for alternatives which were flat, losing the breakneck momentum they had in 2022. Interestingly, an allocator commented on our show earlier in the year that they expected money to leave alts and go back into traditional asset classes.

ETF Launches that we thought were of interest among the Q1 13 F filings:

- Unlimited’s launch of their ETF, the Unlimited HFNDMulti-Strategy Return Tracker ETF (HFND ), HFND seeks to replicate the risk and return profile of the hedge fund industry within the ETF wrapper that offers lower cost diversification opportunities and a tax-efficient return stream for investors. The fund is actively managed and uses modern machine learning in a type of “sophisticated Monte Carlo simulation” or Bayesian model to analyze the hedge fund industry return stream to pinpoint individual factors such as macro, fixed income, etc.

- While ESG flows have slowed, allocators are looking to peel out parts of the ESG market. The KraneShares Global Carbon Strategy ETF (KRBN ) was launched and offers exposure through the futures market to the largest, most liquid regulated carbon markets globally that set caps on how much entities can pollute each year, issuing a set number of allowances to each participant every year. Any amount of carbon dioxide pollution that the company goes above the limit, they are forced to buy more allowances to cover each ton of overage which are auctioned and then traded in the free market.

Stay up to date on ETF and other industry insights and register for a Dakota Live! Call today.